Market price per share formula

The dividend amount can be found alongside the price of the stock. We can calculate the stock price by simply dividing the market cap by the number of shares outstanding.

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Firstly determine the value of the total equity of the company which can be either in the form of.

. In other words we can stay that the Stock Price is calculated as. Its closing price was 11449 per share at the end of Walmarts fiscal year on January 31 2020. Market Capitalization Formula Example 1.

The formula and calculation used for this process are as follows. The market value per share is simply the going price of the. Market value per share.

If the stock trades at an unchanged price-to-earnings ratio of 10 FLUF shares should now be trading at 2222 222 x 10 instead of 20 per share. A the highest composite daily closing price of the stock during the period beginning on the 60th calendar day prior to the change of control and ending. Text PE Ratio frac text Market value per share text Earnings per share PE Ratio Earnings per.

The formula for each market value ratio is as follows. This reveals the value. Calculate price per share by splitting the market worth per share simply by the earnings each share.

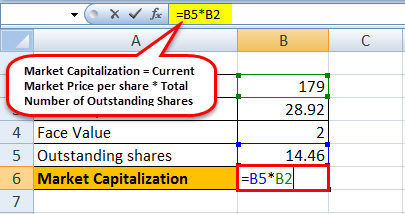

Subtract the amount of the dividend from the price of the stock. It is found by multiplying the companys current market. What is the Market Capitalization Formula.

Formula price means the highest of. ABC limited has equity shares of 1 00000 which is listed in the stock exchange. 10 hours agoIn its most recent quarterly report it shows a total net income of 1944 billion.

And the company has recently reported 1607 billion total shares outstanding. The Market Capitalization formula calculates the total equity value of the company. Therefore the firms market value was roughly 32859 billion 287 billion.

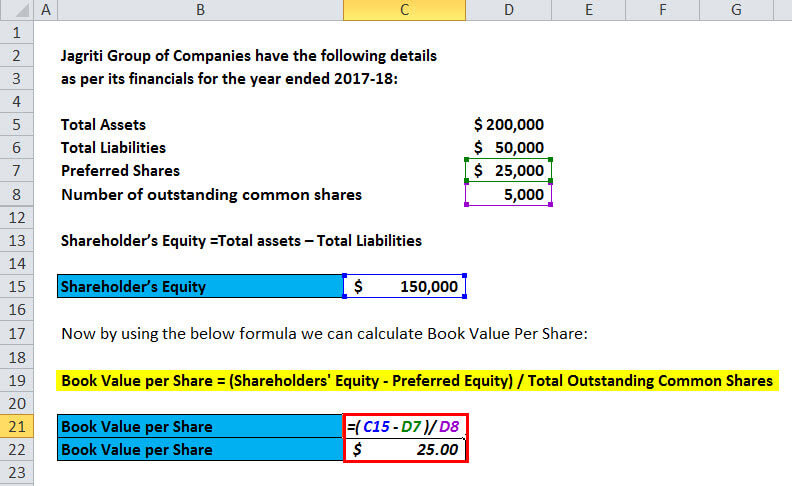

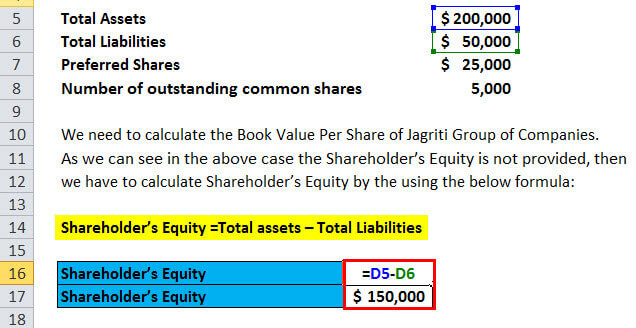

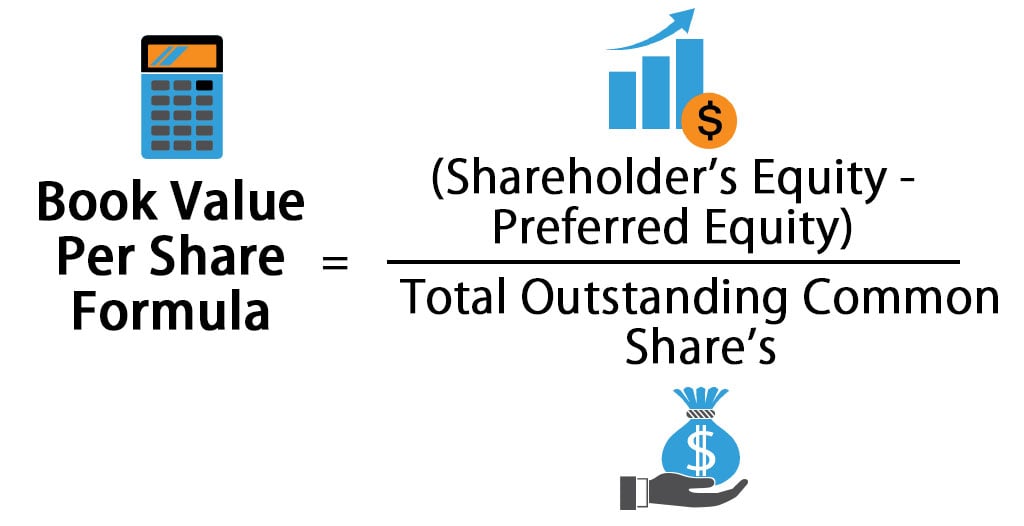

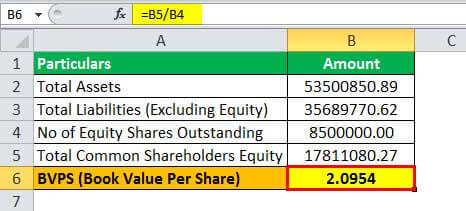

Book Value per Share. PriceEarnings or PE Ratio Price per share Earnings per share EPS Earnings per Share EPS Net Profit Earnings. When looking up the price of the stock.

Market Value Per Share Market value per share is calculated as the total market value of the business divided by the total number of shares outstanding. This will tell you how much the. To calculate this market value ratio divide the price per share by the earnings per share.

To calculate a companys market cap simply multiply the current market price per share by the number of total shares outstanding. By splitting a companys total equity from the amount of outstanding stocks you can. The current market price of each share is INR 2530.

184079 Using PE Ratio Lets suppose Heromotos PE ratio has been 1853 in the past 2465 divided by 14839 166 times the current PE ratio. The formula for common stock can be derived by using the following steps.

Book Value Formula How To Calculate Book Value Of A Company

Book Value Per Share Formula Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

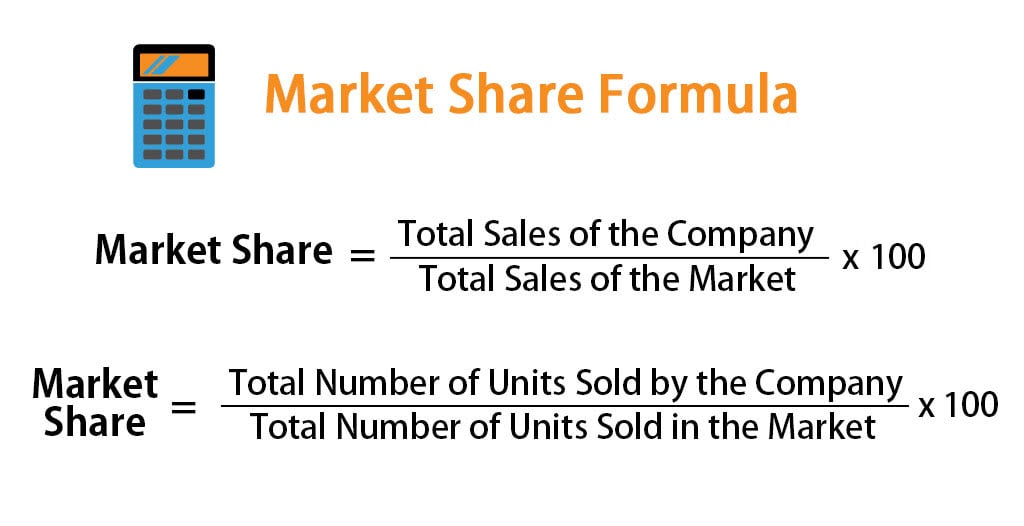

Market Share Formula Calculator Examples With Excel Template

Market Share Formula Step By Step Calculation With Examples

Book Value Per Share Bvps Formula And Ratio Calculator Excel Template

Market Capitalization Formula How To Calculate Market Cap

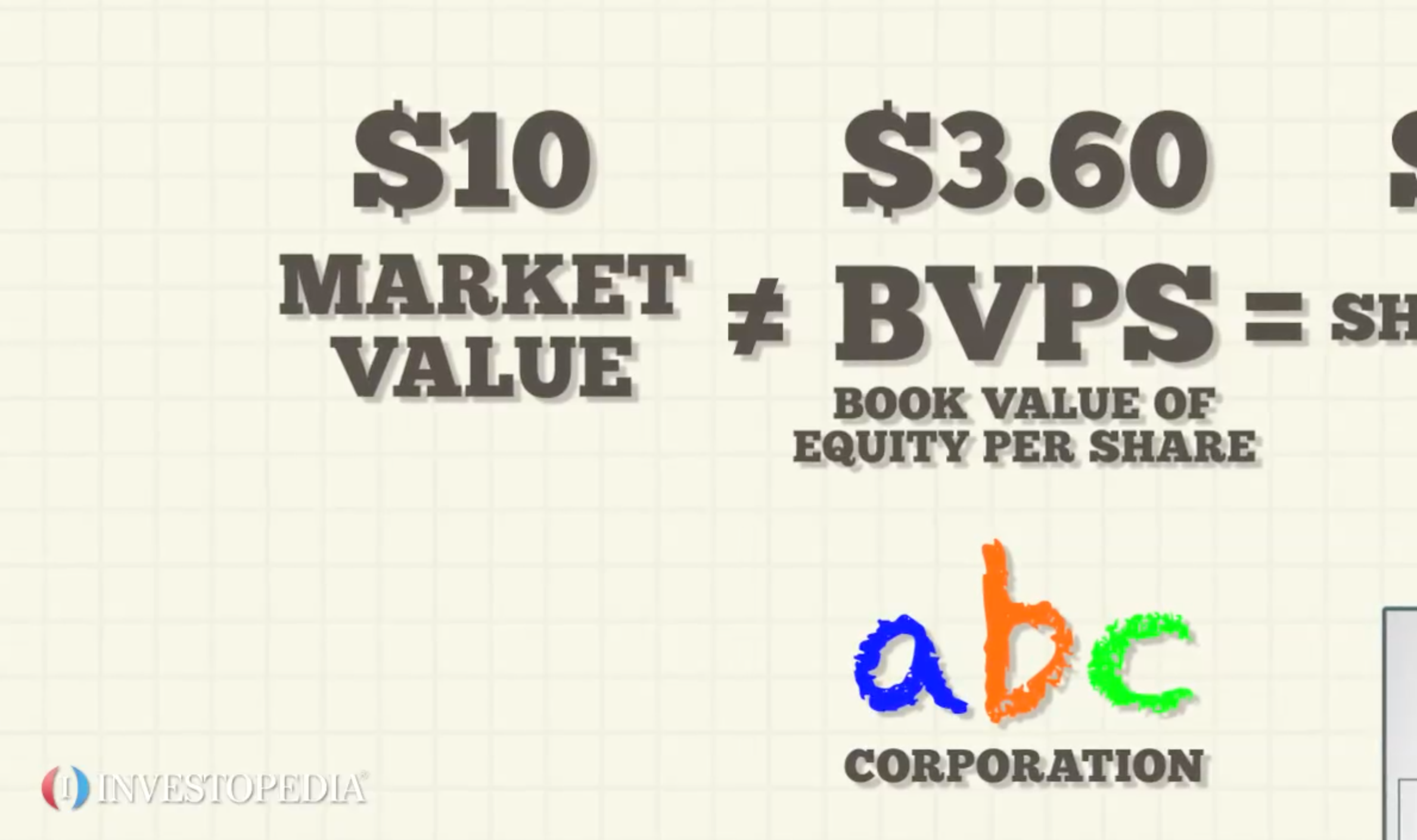

Book Value Per Share Bvps Definition

Book Value Per Share Formula Calculator Excel Template

Book Value Per Share Bvps Formula And Ratio Calculator Excel Template

Book Value Per Share Bvps Formula And Ratio Calculator Excel Template

Book Value Per Share Formula Calculator Excel Template

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

Book Value Formula How To Calculate Book Value Of A Company

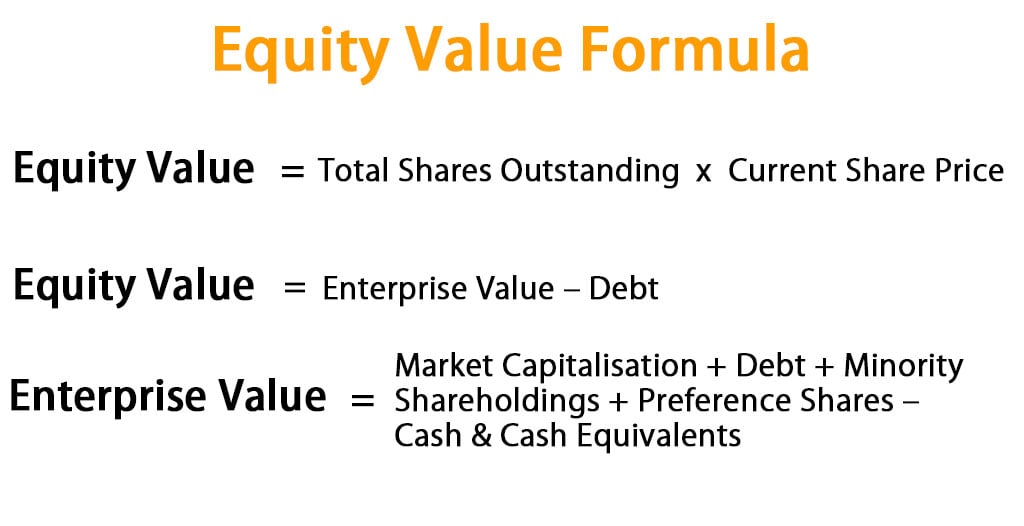

Equity Value Formula Calculator Excel Template

Book Value Vs Market Value How They Differ How They Help Investors

Market Value Definition What Is Market Value